Indian Generic Manufacturers: The World's Pharmacy and Global Exports

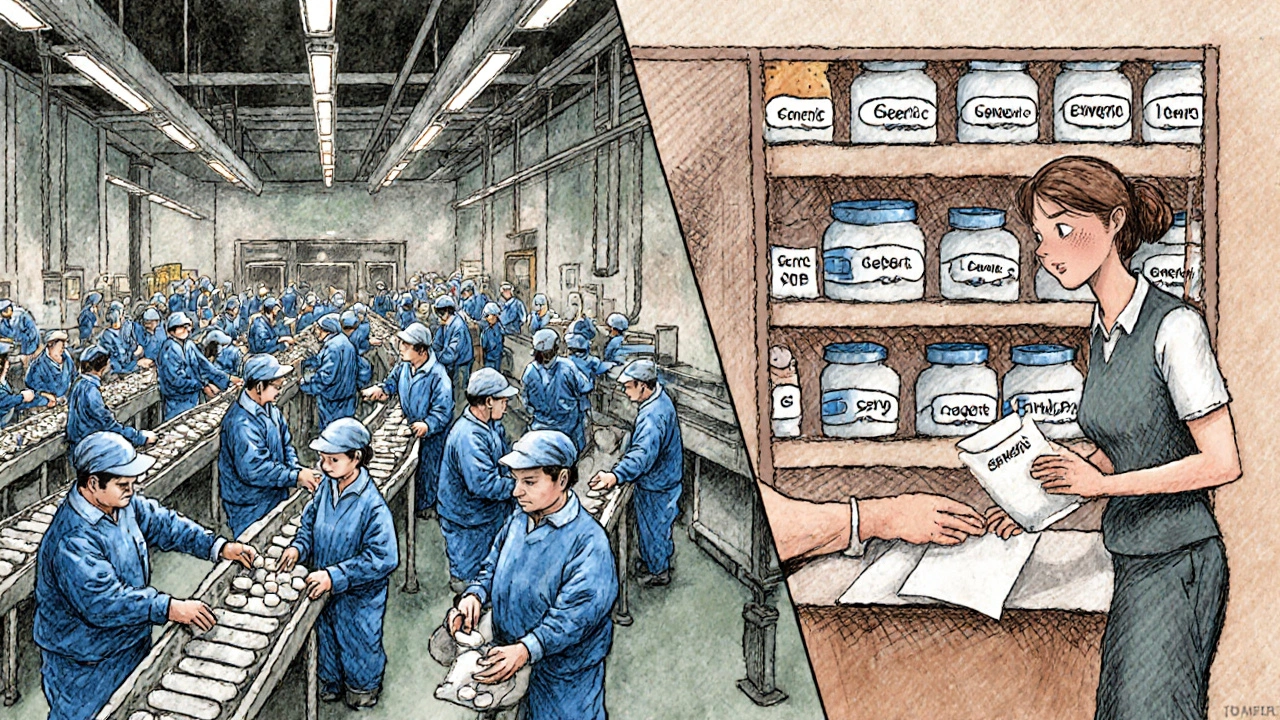

India doesn’t just make medicines-it supplies the world. More than one in five pills sold globally come from an Indian factory. From the antibiotics in a rural clinic in Nigeria to the cholesterol pills in a pharmacy in Ohio, Indian generic manufacturers are quietly keeping billions alive and affordable. This isn’t luck. It’s decades of strategy, regulation, and grit built around one simple idea: if a drug works, it should be cheap enough for anyone to afford.

How India Became the Pharmacy of the World

In the 1970s, India made a bold legal move. It changed its patent laws to stop foreign companies from locking up drug formulas. Instead of paying $10,000 a year for HIV medication, Indian factories could copy the formula and sell it for $100. That single decision turned India into the world’s largest producer of generic drugs. No patents meant no monopolies. No monopolies meant lower prices. And lower prices meant access-for people in India, Africa, Latin America, and beyond. Today, India produces over 60,000 generic medicines and more than 500 active pharmaceutical ingredients (APIs). That’s more types of drugs than any other country. And it’s not just quantity. Indian manufacturers make complex pills-extended-release tablets, injectables, patches-that once only big Western labs could produce. Companies like Sun Pharma and Cipla now invest 6-8% of their revenue in R&D to keep up with demand for harder-to-make generics.The Numbers That Matter

The scale is staggering. In 2023-24, India’s pharmaceutical industry was worth $50 billion. By 2030, it’s expected to hit $130 billion. But the real story is in the exports:- India supplies 20% of all global pharmaceutical exports by volume

- It provides 40% of the United States’ generic drugs

- 33% of the UK’s generic prescriptions come from India

- Half of all medicines used in Sub-Saharan Africa are made in India

- India makes over 60% of the world’s vaccines

Quality vs. Cost: The Real Trade-Off

You can’t talk about Indian generics without talking about price. A course of generic antibiotics made in India might cost $2. The same branded version in the U.S. could be $80. That’s not magic. It’s efficiency. Lower labor costs, streamlined supply chains, and a workforce trained for high-volume production all add up. But here’s the catch: India makes most of its money on volume, not value. It exports 20% of the world’s pills-but only 10% of the total value of global generic sales. Why? Because it sells low-cost versions of old, off-patent drugs. Meanwhile, companies in Europe and the U.S. charge more for newer, complex generics or biosimilars-drugs that mimic expensive biologic treatments like cancer therapies. That’s changing. Indian firms are now investing billions in biosimilars. Biocon and Dr. Reddy’s have spent over $500 million each in the last five years to build biologics labs. In 2020, biosimilars made up just 3% of India’s export value. By 2024, that jumped to 8%. It’s a slow shift-but a critical one.

Where India Still Falls Short

For all its strengths, India’s pharma industry has a major weakness: it depends on China for 70% of its active ingredients. That’s a dangerous gap. When China shut down factories during COVID-19, India felt it immediately. Drug shortages hit hospitals. Emergency supplies ran low. The Indian government responded with a $400 million incentive program to build domestic API plants. The goal? To cut China’s share to 53% by 2026. It’s a big challenge. Building API factories takes years, billions in capital, and deep technical expertise. But without it, India’s entire export model is vulnerable. Another issue? Regulatory hiccups. While 85-90% of Indian plants now pass FDA inspections (up from 60% in 2015), failures still happen. In 2023, FDA inspectors found translation errors in 22% of regulatory documents. Packaging inconsistencies, shipping delays, and rare batch issues (like inconsistent levothyroxine dissolution) have led to complaints on consumer forums. These aren’t widespread-but they’re real enough to erode trust.Who Uses Indian Generics-and Why

In the U.S., nine out of ten prescriptions are for generics. Of those, nearly 40% come from India. Patients don’t always know it. Pharmacists fill the script. Insurance companies prefer the cheapest option. And for many, that’s an Indian-made pill. Patient satisfaction is high. On PharmacyChecker.com, 87% of users who took Indian generics rated their experience positively. The top reason? Cost. A diabetes pill that costs $120 in the U.S. might be $12 from an Indian supplier. In Africa, Indian drugs are lifesavers. Doctors Without Borders reported that Indian-sourced antimalarials cut treatment costs by 65% while keeping 95% effectiveness. In Brazil, India supplies half of the public health system’s HIV meds. In the UK, the NHS relies on Indian generics for 33% of its prescriptions. Patients there give them an average 4.2 out of 5 rating-though some complain about taste or pill size.

The Future: From Pharmacy to Innovation Hub

India isn’t content being just the low-cost supplier. The government launched Pharma Vision 2047, aiming for $190 billion in exports by 2047. That’s not just more pills-it’s better pills. The focus now is on three things:- Building domestic API production to end reliance on China

- Scaling up biosimilars and complex generics

- Improving regulatory compliance to 95%+ inspection pass rates

What This Means for You

If you’re in the U.S., Europe, or a developing country, Indian generics are already part of your healthcare. You might not see the label. But you’ve probably taken one. For patients, that means lower out-of-pocket costs. For governments, it means sustainable public health budgets. For global health, it means treating diseases like HIV, malaria, and hepatitis without waiting for expensive branded drugs. But it also means staying informed. Not all Indian manufacturers are equal. Stick to companies with FDA or WHO-GMP certification. Check drug sources through trusted pharmacy sites. If a generic seems too cheap, ask why. India’s success isn’t about cutting corners. It’s about cutting costs without cutting quality. And that’s a model the world still needs.Are Indian generic drugs safe?

Yes, the vast majority are. Over 650 Indian manufacturing plants are FDA-approved, and more than 2,000 meet WHO-GMP standards. Compliance rates have risen from 60% in 2015 to 85-90% today. While isolated incidents of quality issues have occurred, they represent a tiny fraction of total exports. Always choose generics from manufacturers with recognized international certifications.

Why are Indian generic drugs so much cheaper?

India eliminated product patents in the 1970s, allowing local companies to copy and produce off-patent drugs without paying licensing fees. Combined with lower labor costs, high-volume production, and streamlined supply chains, this lets them offer the same medicines at 30-80% less than branded versions. They don’t spend billions on marketing or R&D for old drugs-just on making them reliably and affordably.

Do Indian generics work as well as brand-name drugs?

Yes, by regulatory standards. The FDA requires generics to have the same active ingredient, strength, dosage form, and bioequivalence as the brand-name version. Studies show they work just as effectively. Some patients notice minor differences in fillers or coating, which can affect taste or how fast a pill dissolves-but these don’t change the drug’s effectiveness.

Is India replacing China as the main source of global medicines?

Not yet, but it’s moving in that direction. China produces more APIs and at lower prices, but it has only 153 FDA-approved plants compared to India’s 650. India’s strength isn’t just cost-it’s compliance. For countries that need reliable, regulated medicines (like the U.S. and EU), India is the preferred supplier. China remains dominant in raw materials, but India leads in finished, quality-controlled products.

What’s the biggest threat to India’s pharmaceutical dominance?

Its reliance on China for 70% of active pharmaceutical ingredients (APIs). A disruption in Chinese supply-due to policy, natural disaster, or geopolitical tension-can cause global shortages. India’s $400 million incentive plan aims to fix this by boosting domestic API production, but it will take years. Without progress here, India’s export growth could stall.

Can Indian companies compete with big pharma on innovation?

They’re trying. While Western firms focus on new chemical entities, Indian companies are investing heavily in biosimilars-drugs that copy expensive biologics like cancer treatments. Companies like Biocon and Dr. Reddy’s are now global leaders in this space. They’re not inventing new drugs yet, but they’re making cutting-edge treatments affordable. That’s innovation with impact.

Let’s be real-India’s generics are just pharmaceutical colonialism with better PR. They copy our drugs, sell them dirt cheap, and then act like heroes while we pay for the R&D. It’s not innovation-it’s intellectual theft wrapped in a humanitarian cape.

I’ve taken Indian generics for years. Never had an issue. My blood pressure med? $12 a month. Same pill, 90% cheaper. Why fight it?

Look, we’re talking about a civilization that figured out how to make life-saving medicine accessible to the masses while the West was busy patenting aspirin and charging $500 for it. This isn’t just about economics-it’s about moral philosophy. Who gets to decide who lives and who dies based on their zip code? India said: nobody. They turned medicine into a public good, not a profit metric. And now the same people who cried about ‘intellectual property’ when their patents expired are suddenly shocked that the Global South learned how to play the game? Wake up. The game was rigged from the start. The real scandal isn’t that India makes cheap drugs-it’s that America lets people go bankrupt just to breathe.

India’s pharma story is one of the quietest revolutions of the 21st century. It’s not flashy like SpaceX or Tesla, but it’s saving more lives every day. I’ve seen it firsthand-my cousin in rural Kenya got HIV meds because of a pill made in Hyderabad. No drama, no headlines, just people doing the work. And now they’re moving into biosimilars? That’s not just keeping up-it’s catching up and then passing us. The future of medicine isn’t in Silicon Valley boardrooms. It’s in factories with 24/7 shifts and engineers who don’t care about IPOs, they care about whether the pill dissolves right.

Oh wow, India’s the pharmacy of the world? Cool. Meanwhile, my local pharmacy just told me my insulin is on backorder because China shut down a supplier-and guess who’s supposed to fix it? India. But they can’t even make their own APIs without China’s help. So we’re outsourcing our survival to a country that might not even like us? Thanks, globalization.

As an Indian, I’m proud of what our pharma industry has achieved. But we also know the cracks. We see the delays at customs, the translation errors on labels, the factory inspections that barely pass. We’re not perfect. But we’re trying. The government’s push for API self-reliance? It’s real. And it’s hard. But if we succeed, we won’t just be the world’s pharmacy-we’ll be its partner. And that’s something worth fighting for.

Let’s clarify terminology: ‘generic’ means bioequivalent, not ‘cheap knockoff.’ The FDA requires identical active ingredients, dosage, and bioavailability. If a pill passes inspection, it works the same. The differences people notice-taste, size, coating-are inert fillers. Not safety issues. Stop conflating perception with reality. Also, ‘Indian generics’ aren’t a monolith. Sun Pharma and Cipla are world-class. Some small players aren’t. Do your homework. Don’t buy from random websites. Use certified suppliers. Simple.

Yeah, sure, India’s great-until you’re the one who gets a batch with inconsistent levothyroxine levels and your TSH goes haywire. You think ‘85% pass rate’ sounds good? That’s 1 in 7 plants failing. That’s not ‘pharmacy of the world.’ That’s Russian roulette with your hormones. And don’t even get me started on the 22% translation errors. You think a nurse in Nebraska is gonna read Hindi on the label? No. They just hand you the pill. And if you crash? Well, blame the system.

I work in a hospital in Kerala. We use Indian generics every day. My patients can’t afford anything else. But I’ve also seen the stress-when a shipment gets held up because of a paperwork glitch, or when a new batch tastes different and people panic. It’s not about being anti-India. It’s about being human. We need better systems-not just more pills. More checks. More transparency. And maybe, just maybe, we need to pay a little more so the workers making these drugs aren’t getting paid pennies.

India’s entire pharma empire is built on a lie. The FDA inspections? Staged. The compliance stats? Doctored. The Chinese API dependency? A distraction. The real story? The U.S. government quietly approved Indian plants because they needed cheap drugs during the opioid crisis. Now they’re stuck. And the moment China cuts off supply, the whole house of cards collapses. Who’s really in control? Not India. Not the FDA. The real power? The Chinese state. They hold the keys. India’s just the middleman with a flag.

My grandad in Cork used to get his blood thinner from India. Said it worked better than the Irish version-no weird aftertaste. We didn’t know where it came from until he showed us the bottle. Now I check every prescription. If it’s Indian-made and FDA-approved? I’m cool with it. The world’s getting smaller, and medicine should be too. No nationalism in pills, please.

People forget: India doesn’t just make pills. They make access. In places where a doctor is 50km away and a fridge doesn’t work, a stable, cheap, shelf-stable generic is the difference between life and a funeral. It’s not glamorous. It’s not sexy like AI diagnostics. But it’s the quiet backbone of global health. And yeah, they’ve got flaws. But they’re the only ones trying to fix them at scale. That’s worth more than a tweet.

I’m so glad someone finally wrote this. The stigma around Indian generics is ridiculous. I’ve taken them for 8 years. My cholesterol is stable. My bank account is intact. And I’ve never once felt ‘lesser’ because my pill came from Hyderabad. Why do we assume cheaper = worse? That’s not science. That’s prejudice. Let’s stop shaming people for saving money-and start celebrating the people who made it possible.

It’s ironic, isn’t it? The same people who demand ‘affordable healthcare’ in their own countries are the first to look down their noses at the very system that delivers it. We want the medicine. We just don’t want to know where it came from. Or who made it. Or how much they were paid. That’s not ethics. That’s convenience dressed up as morality.

Oh wow, so now we’re supposed to be grateful that a country with zero patents and dodgy inspections is keeping us alive? Thanks, but I’ll take my $120 insulin from the U.S. and pay for it like a grown-up. At least I know who’s responsible when it fails.