How to Appeal a Prior Authorization Denial for Your Medication

When your insurance denies coverage for a medication your doctor prescribed, it’s not just a bureaucratic hiccup - it’s a roadblock to your health. You’ve got a prescription, your doctor says it’s necessary, and yet your insurer says no. That denial letter can feel like a punch in the gut, especially if you’re already dealing with a serious condition. But here’s the truth: prior authorization denials are often wrong, and most of them can be overturned. In fact, 82% of appeals get approved when done right. You don’t need a lawyer or a medical degree. You just need to know the steps - and do them carefully.

Understand Why Your Medication Was Denied

The first thing you need to do is read the denial letter. Not skim it. Read it line by line. Insurance companies don’t deny coverage randomly. They give a reason, and it usually falls into one of three categories:- Incomplete paperwork (37% of denials): Missing forms, wrong patient ID, or unclear doctor notes.

- Lack of medical necessity (48%): The insurer thinks another drug should be tried first, even if your doctor says it won’t work for you.

- Not covered by your plan (15%): The medication isn’t on their approved list, or it’s classified as experimental or non-formulary.

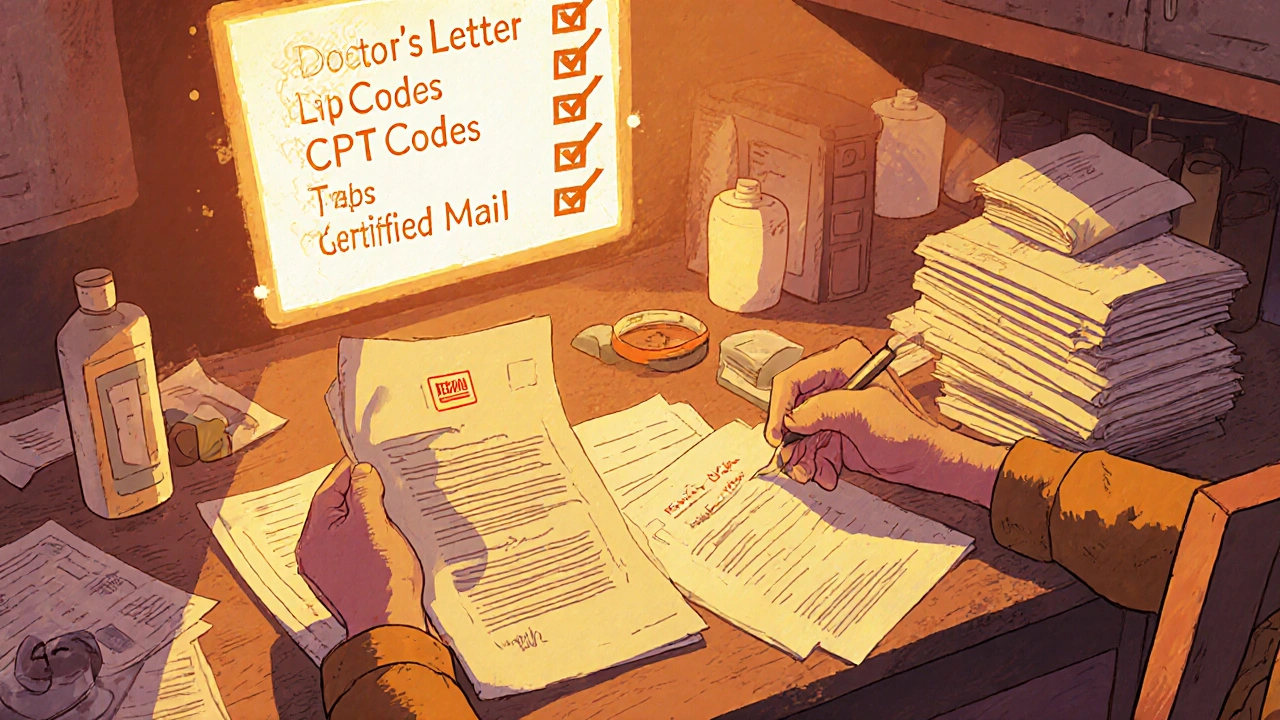

Gather Every Piece of Medical Evidence

An appeal isn’t a plea. It’s a case built on facts. The more solid your evidence, the higher your chance of winning. Here’s what you need:- Your doctor’s written statement explaining why this specific medication is necessary - not just a note, but a full letter.

- Lab results, test reports, or imaging that support your diagnosis.

- History of other medications you’ve tried and why they failed. Be specific: “Metformin at 1000mg daily for 6 months caused severe nausea and no blood sugar improvement.”

- Any side effects you experienced with alternatives.

- Current symptoms and how they’re affecting your daily life.

Follow Your Insurer’s Exact Appeal Process

Every insurance company has its own rules. You can’t just send a letter and hope for the best. You need to follow their procedure to the letter.- Check your plan documents or their website for the “Appeals and Grievances” section.

- Find out if they require online submission, fax, or mail. CVS/Caremark requires faxing to 1-888-836-0730. UnitedHealthcare requires online portal submission. Get it wrong, and your appeal gets tossed.

- Include your full name, member ID, date of birth, drug name, and the denial date.

- Submit your appeal within 180 days of the denial date. That’s the federal deadline under the Affordable Care Act.

Write a Clear, Focused Appeal Letter

Your appeal letter isn’t a story. It’s a legal argument. Stick to facts. Use the insurer’s own coverage rules against them. Start with:- Your full name and ID number.

- The date of the denial and the drug name.

- A direct reference to the reason given in the denial letter.

“Your letter dated [date] denied coverage for [drug] because ‘alternative therapies should be tried first.’ However, I have already tried [Drug A] for 4 months and [Drug B] for 3 months, both of which caused [side effect]. My doctor’s records show these treatments were ineffective and unsafe for me. According to your plan’s Clinical Guidelines, Section 4.2, this medication is approved when prior therapies have failed with documented intolerance. I’ve attached all supporting records.”Include specific codes if possible: ICD-10 diagnosis codes and CPT procedure codes. Studies show 89% of approved appeals include these. If you don’t know them, ask your doctor’s office to add them.

Get Your Doctor Involved

Your doctor’s voice carries weight. Most insurers have a “peer-to-peer review” option - that means a doctor from your plan will talk to your doctor. This step alone increases approval rates by 32%. Call your doctor’s office and say: “I’m appealing my medication denial. Can you please call the insurer’s medical director to discuss why this drug is medically necessary for me?” Most offices will do this at no cost. If they hesitate, remind them that the AMA says 79% of patients abandon treatment due to prior auth delays - and that’s a risk they’re ethically obligated to prevent.Track Everything and Follow Up

After you submit your appeal, the insurer has up to 60 days to respond if you’re on a self-insured plan (most employer plans), or 30 days for most commercial plans. But don’t wait. Call every 5-7 business days. Ask for the case number, the name of the reviewer, and a status update. Keep a log:- Date of submission

- Method of submission (mail, fax, online)

- Confirmation number

- Names of reps you spoke with

- What they promised

What If Your Appeal Gets Denied Again?

If your first appeal is denied, you still have options. You can request an external review - an independent third party that looks at your case. Federal law gives you 365 days from the final denial to do this. Some states have shorter windows (60-180 days), so check your state’s insurance department website. You can also file a complaint with your state’s Department of Insurance. In 2023, 41% of initial denials were due to simple administrative errors - typos, missing pages, wrong forms. These are fixable. If your insurer is being unreasonable, regulators will take notice.Know Your Numbers

This isn’t just about one drug. It’s about a broken system. Here’s what you’re up against - and why you need to fight:- 6% of prior auth requests are denied - that’s about 18.7 million cases a year in the U.S.

- Only 11% of people appeal - but 82% of those appeals succeed.

- 93% of doctors say prior auth causes treatment delays.

- 34% of physicians report patients had adverse health events because they couldn’t get their meds on time.

What to Do Next

1. Get your denial letter in writing. If you don’t have it, call your insurer and demand it. 2. Ask your doctor for a detailed letter and medical records. 3. Find your insurer’s appeal instructions - don’t guess. 4. Write your appeal letter using the exact reason from the denial. 5. Submit it with all documents and proof of delivery. 6. Call every week until you get a decision. It takes 6-8 hours of your time. But if you succeed, you could save hundreds or thousands of dollars - and more importantly, you’ll get the medicine you need to stay healthy.How long do I have to appeal a prior authorization denial?

You have 180 days from the date of the denial letter to file your appeal. This is the federal deadline under the Affordable Care Act. Some insurers may have shorter internal deadlines, so always check your plan documents. If you miss the deadline, you may still be able to request an external review within 365 days, but your chances drop significantly.

Can I appeal without my doctor’s help?

You can try, but your chances of success drop dramatically. Insurance companies rely on clinical evidence, and your doctor’s statement is the most powerful part of your appeal. Without it, they’ll likely say there’s no proof the drug is medically necessary. If your doctor won’t help, ask for a referral to another provider who will. Many clinics have patient advocates who can assist.

Why do insurers deny medications that doctors prescribe?

Insurers deny medications to control costs. They use step therapy - forcing patients to try cheaper drugs first - even when those drugs won’t work. Many denials happen because of outdated formularies, clerical errors, or automated systems that don’t understand complex medical cases. Studies show 41% of denials are due to simple paperwork mistakes, not medical judgment.

What if my medication is only covered if I try another drug first?

That’s called step therapy, and it’s common. To appeal, you need to prove the alternative drug failed or caused side effects. Document every attempt - dates, doses, symptoms, lab results. If you tried the drug for the full recommended time and it didn’t work, that’s your case. Insurers must follow their own rules - and if your medical records show clear failure, they’re required to approve the next step.

Can I get financial help while waiting for my appeal?

Yes. Many drug manufacturers offer patient assistance programs that provide free or discounted medications during appeals. Check the manufacturer’s website or call their patient support line. Nonprofits like the Patient Access Network Foundation (PAN) and the HealthWell Foundation also help with copays. Don’t wait until you run out - apply early.

Does Medicare cover prior authorization appeals differently?

Yes. Medicare Advantage plans must respond to prior auth requests within 72 hours as of 2024 - much faster than commercial insurers. Appeal success rates are also 22% higher than commercial plans. If you’re on Medicare, use the official Medicare Appeals website or call 1-800-MEDICARE. You can also request a face-to-face hearing if your case is urgent.

What if my appeal is approved but the drug is still too expensive?

Approval doesn’t always mean affordability. Ask your pharmacist if there’s a generic version or a lower-cost alternative on formulary. You can also ask your doctor to request a tier exception - asking the insurer to put your drug on a lower cost tier. Some insurers offer co-pay cards or coupons. Always ask - many patients don’t realize these options exist.

I got denied for my insulin last year. Called them 14 times. Sent certified mail. Got a letter back saying "criteria not met" - no details. I screamed at the rep until they patched me to a supervisor. Got approved in 3 days. Don't let them gaslight you. They're not your friends.

Insurance companies are just corporate vampires. They don't care if you die. They care about quarterly profits. I saw a guy on Reddit who got denied for a $300 pill because he was "over 50". That's not policy. That's eugenics with a spreadsheet.

You're all missing the point. This isn't about appeals or forms or doctors' letters. It's about the commodification of human life. We've turned healthcare into a market transaction. The real problem is capitalism. Until we dismantle the system, you're just rearranging deck chairs on the Titanic.

I've been through this three times. The system is broken but not hopeless. I used to think it was just paperwork. Then I realized it's about persistence. I once sent a 7-page timeline with photos of my symptoms, lab results, and a handwritten note from my grandma saying "I've never seen him this sick." They approved it. Not because of the forms. Because they couldn't ignore the humanity behind it.

While the procedural guidance provided is generally sound, I would urge readers to verify the specific regulatory timelines applicable within their respective state jurisdictions, as these may vary from the federal minimums referenced. Additionally, the assertion regarding the 82% appeal success rate should be contextualized with the underlying sample size and methodology of the cited study.

why do we even bother? they gonna deny anyway. just take the cheap stuff. or die. its all the same. 😔

You people are naive. This isn't about "appeals" or "paperwork." It's about the elite controlling access to medicine like it's a privilege, not a right. Your doctor? A pawn. Your appeal? A theater. The only thing that works is public shaming. Post their names. Leak their emails. Make them scared. That's how change happens.

I tried this last year. Sent everything. Got denied again. Called back. The rep said "you forgot the CPT code on page 3." I checked. It was there. They just didn't scan it right. I sent it again with a note: "It's on page 3. I know you didn't see it. Please look." Approved next day. Details matter. Don't assume they're competent.