How Medicare Drug Price Negotiations Work and What It Means for Your Prescription Costs

For decades, Medicare couldn’t negotiate drug prices. That meant billions in spending were locked in at whatever manufacturers charged-no bargaining, no discounts, no leverage. That changed in 2022 with the Inflation Reduction Act. Now, for the first time, the federal government is directly negotiating prices for the most expensive prescription drugs covered under Medicare Part D. And the results? Some drugs are getting slashed by nearly 80%.

What Exactly Is Being Negotiated?

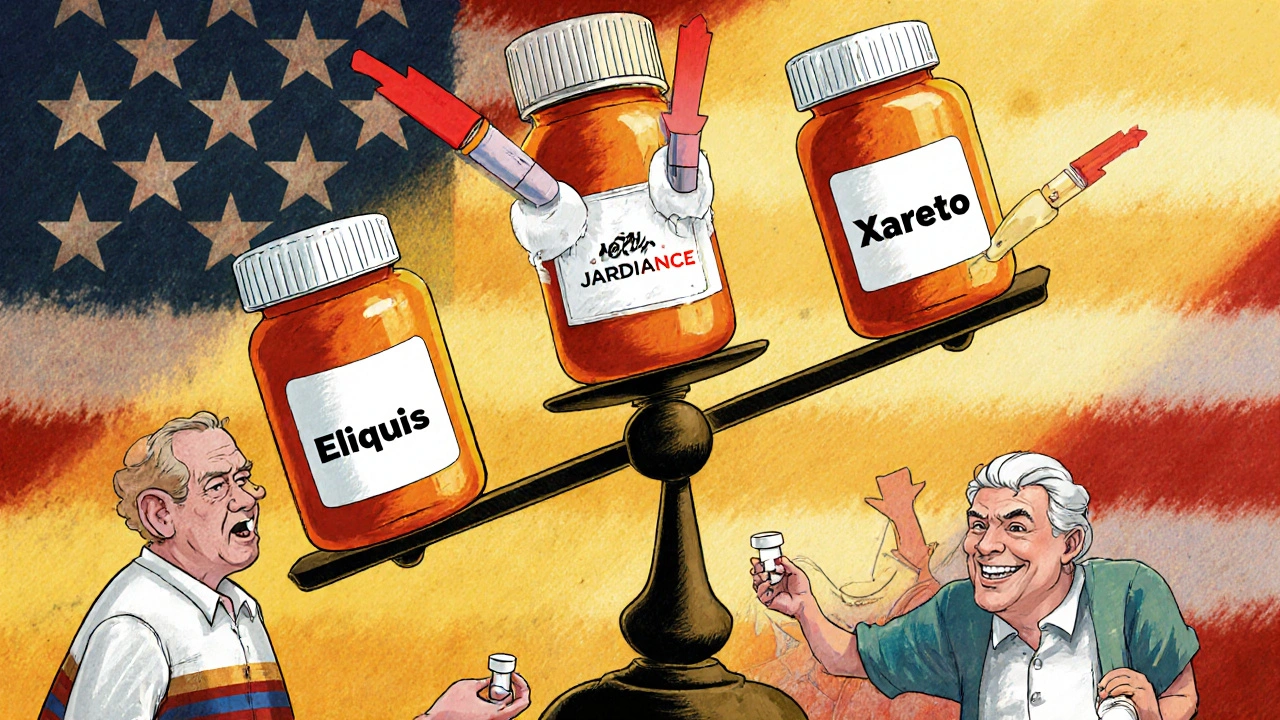

The Medicare Drug Price Negotiation Program doesn’t touch every drug. It only targets single-source brand-name medications that have been on the market for at least seven years (or 11 for biologics) and have no generic or biosimilar competition. These are often the drugs people rely on for chronic conditions-diabetes, heart disease, arthritis, and more. The first 10 drugs selected for negotiation in 2024 include big-name medications like Eliquis (for blood clots), Jardiance (for diabetes), and Xarelto (also for clot prevention). These drugs cost Medicare over $50 billion in 2022 alone. Eliquis, for example, accounted for $6.3 billion of that total. CMS, the agency that runs Medicare, started by sending manufacturers an initial price offer in February 2024. Manufacturers had 30 days to respond. Then came three rounds of talks-some in person, some via written offers. By August 1, 2024, all 10 negotiations were complete. The final prices? Discounts ranged from 38% to 79% compared to what Medicare was paying before.How Are These New Prices Calculated?

This isn’t random haggling. The law sets strict rules for how low the price can go. CMS uses two main benchmarks:- The drug’s current weighted average net price across all private insurers (after rebates and discounts)

- A percentage of the drug’s average non-Federal Average Manufacturer Price (non-FAMP)-a government-tracked baseline

When Will You See the Savings?

The first negotiated prices take effect on January 1, 2026. That’s when pharmacies and Part D plans must start charging the new, lower prices to Medicare beneficiaries. If you’re on Medicare and take one of these 10 drugs, you’ll see your out-of-pocket costs drop immediately. Here’s how it breaks down for you:- If you’re in the coverage gap (the “donut hole”), your savings will be huge-you pay 25% of the negotiated price instead of the old list price.

- If you’re in the catastrophic phase, your savings might be smaller because you’re already paying a fixed amount, but your plan will still pay less overall, which could help keep premiums down in future years.

- If you’re still in the initial coverage phase, your copay will go down proportionally to the price drop.

What About the Other Side? Manufacturers and Innovation

Drugmakers aren’t happy. Four of the 10 companies sued the government, claiming the law violates their constitutional rights. A federal judge dismissed those lawsuits in August 2024, but appeals are expected. PhRMA, the industry’s main lobbying group, claims the program will cut innovation funding by $112 billion over 10 years. But here’s the catch: the Office of Management and Budget says those numbers are wildly inflated. Real-world data from the VA, which has negotiated drug prices for decades, shows it doesn’t hurt innovation. The VA pays about 40% less than Medicare did before this law-and the U.S. still leads the world in new drug development. Also, the law protects newer drugs. Only drugs that are at least seven years old are eligible. That means breakthrough treatments like new cancer drugs or Alzheimer’s therapies won’t be touched for years. The goal isn’t to kill innovation-it’s to stop overcharging for old drugs that have long since paid off their R&D costs.What’s Next? More Drugs, More Cuts

This is just the beginning. In 2027, 15 more drugs will be added to the list-including Farxiga and Stelara. Then 15 more in 2028, and 20 every year after that. By 2029, over 70 drugs could be under negotiation. And it’s not stopping at Part D. Starting in 2028, Medicare will also start negotiating prices for drugs given in doctor’s offices-like infusions for rheumatoid arthritis or chemotherapy. That’s a whole new layer. Right now, doctors get paid 6% above the drug’s average sales price. With the new system, they’ll get 6% above the negotiated price. That could mean less profit for clinics, which is why some physician groups are worried. But it also means fewer incentives to push expensive drugs just because they pay more.

What This Means for You

If you’re on Medicare and take one of these high-cost drugs, you’re going to pay less. That’s the bottom line. You won’t need to switch plans, apply for aid, or jump through hoops. The price drops automatically. Even if you’re not on Medicare, this could still affect you. Employers, Medicaid programs, and private insurers often use Medicare’s negotiated prices as a reference. If your insurer sees Medicare paying $100 for a drug instead of $500, they’ll push to match that. It’s already happening in states like California and Colorado, where Medicaid adopted the Medicare rates early. The bigger picture? This is the first time the U.S. has taken real control over drug pricing. Other countries have done this for years-Canada, the UK, Germany. They pay far less for the same drugs. Now, the U.S. is catching up.Common Questions About the New Drug Prices

Will my Medicare premiums go down because of these price cuts?

Not right away, but over time, yes. Medicare Part D premiums are based on how much the program spends on drugs. If spending drops by tens of billions, premiums will eventually follow. The first savings won’t show up in 2026 premiums, but by 2028 or 2029, you could see a noticeable decrease.

Can I get these lower prices before January 1, 2026?

No. The negotiated prices are legally binding only starting January 1, 2026. Pharmacies and insurers need time to update their systems. Even if a manufacturer offers a discount early, your plan isn’t required to accept it until the official date.

What if my drug isn’t on the list? Will I ever get a discount?

It depends. The list grows every year. If your drug is a single-source brand that’s been on the market for more than seven years, it could be added in a future cycle. Also, if a generic or biosimilar enters the market, your price might drop anyway-because competition forces prices down naturally.

Are these price cuts permanent?

Yes, as long as the law stays in place. The negotiated prices are locked in for the entire year. If the drug’s cost rises due to inflation, CMS can adjust the price upward-but only up to the inflation cap set by law. Manufacturers can’t just raise prices again without going through the negotiation process again.

Will I have to switch to a different drug because of this?

Not because of the negotiation itself. Your plan can’t force you off a drug just because its price dropped. But if your plan changes its formulary (which happens every year), you might be moved to a cheaper alternative. That’s standard practice-it’s not new. If you’re on a drug you need, you can request an exception.

What to Do Now

If you take one of the 10 negotiated drugs, mark January 1, 2026 on your calendar. That’s when your copay will drop. In the meantime:- Check your Part D plan’s formulary each year during open enrollment (October 15-December 7).

- Ask your pharmacist if your drug is on the negotiation list-many are tracking this now.

- If you’re on a fixed income, consider applying for Extra Help (Low-Income Subsidy). Even with lower prices, out-of-pocket costs can still add up.

This is huge. If private insurers start using these prices as benchmarks, we could see a domino effect across the entire system. No more paying $500 for a drug that costs $100 elsewhere.

It’s not perfect, but it’s the first real crack in the wall.

I’ve been on Jardiance for five years. My copay used to be $412 a month. I can’t believe it’s going to drop to under $90. I almost cried reading this. Thank you for finally doing something that makes sense.

pharm companies are gonna go bankrupt lol

they been rippin us off for decades

if they cant make profit on old drugs then they shoulda invested in new ones

now they cry? lolol

The structural integrity of this policy is remarkable. It leverages market data to enforce fairness without punitive measures. The inclusion of clinical utility as a factor ensures that innovation is not stifled, only exploitation is curtailed. This is a model for other nations to study.

I just called my pharmacist and they confirmed my Eliquis will drop from $560 to $120 in January. I’ve been saving for months just to afford it. This is life-changing. I don’t know how to thank you all for pushing this through.

Negotiation > monopoly pricing. Period. The VA’s been doing this for 40 years. US leads in innovation. End of story.

You know what’s wild? This is the first time the government’s treated medicine like a public good instead of a profit center. Other countries did this decades ago. We’re finally catching up. Not because we’re smart. Because we were forced to.

Still feels surreal. My mom’s on Xarelto. She’s gonna breathe again.

The pharmaceutical industry's litigation strategy is transparently designed to delay equitable access. Their claim of innovation erosion is statistically indefensible, especially given the VA's long-standing negotiation framework and the U.S.'s continued dominance in biopharmaceutical R&D output. The moral hazard of pricing essential therapeutics beyond economic reason is not merely fiscal-it is ethical. To oppose this is to prioritize shareholder dividends over patient survival.