Annual Savings from FDA Generic Drug Approvals: Year-by-Year Breakdown

The U.S. healthcare system saves billions every year because of generic drugs. Not just a little here and there-tens of billions. And it’s not magic. It’s the result of a specific, well-documented process: when the FDA approves a new generic version of a brand-name drug, prices drop fast, and patients, insurers, and taxpayers all benefit. But how much? And which years delivered the biggest payoffs? Let’s break it down, year by year.

How Generic Approvals Drive Savings

When a brand-name drug’s patent expires, companies can apply to the FDA to make a generic version. This isn’t just copying the pill. It’s proving the generic works the same way, at the same strength, and in the same form. Once approved, competition kicks in. One generic? Prices might drop 20-30%. Two or three? They can fall over 70%. That’s not theory. That’s what the FDA saw in 2021: after generic entry, prices for those drugs dropped by more than 70% on average.

The savings aren’t just about the new generic’s price. They also force the original brand to lower its price to stay competitive. So you get two savings streams: what patients pay for the cheaper generic, and the reduced cost of the brand drug still being used. The FDA tracks this by measuring sales and pricing for 12 months after each new generic approval. That’s their method. It’s precise. It’s focused on the impact of each new entry.

Year-by-Year Breakdown: FDA’s New Generic Savings

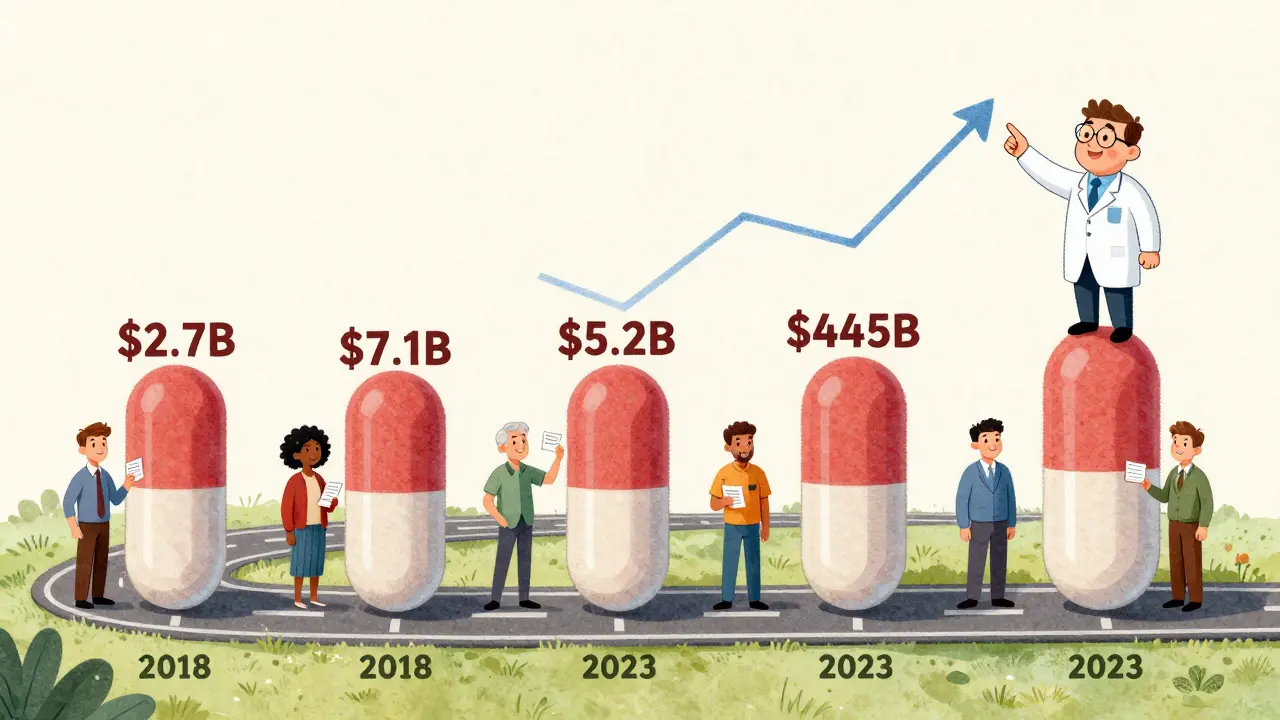

The FDA doesn’t just report numbers-they tell a story. Here’s what happened with new generic approvals each year (meaning the first generic version of a brand-name drug):

- 2018: $2.7 billion saved

- 2019: $7.1 billion saved - the highest single-year total in recent memory

- 2020: $1.1 billion saved

- 2021: $1.37 billion saved

- 2022: $5.2 billion saved - a sharp rebound

Why the wild swings? It’s all about which drugs lost their patents. In 2019, several high-cost medications-like the asthma drug Advair and the blood thinner Eliquis-got their first generics. Those aren’t small drugs. They’re billion-dollar sellers. When generics hit, the savings exploded. In 2020, fewer big-name drugs came off patent. That’s why the number dropped. Then in 2022, the FDA approved several generics for major drugs in large markets. One report noted that several of those approvals were for drugs with annual sales over $1 billion. That’s why savings jumped back up.

And it’s not just about the number of approvals-it’s about which drugs. In 2021, nearly half of the $1.37 billion in savings came from just five generic drugs. And 21 new molecular entity (NME) generics-meaning entirely new drugs that had never been on the market before-accounted for $1.4 billion of the total savings from first generics that year. That’s the power of hitting the jackpot: one new generic for a blockbuster drug can outpace dozens of smaller ones.

Total Savings: What All Generics Are Doing Together

The FDA’s number only shows savings from drugs approved that year. But generics are already on the market, too. That’s where the Association for Accessible Medicines (AAM) comes in. They look at the entire year and calculate how much the U.S. spent on generics versus what it would have cost if everyone had bought brand-name versions.

In 2023, that total hit $445 billion. Yes, billion. That’s more than the entire GDP of many countries. For context:

- 2022: $408 billion saved

- 2021: $385 billion saved

- 2020: $338 billion saved

That’s not a trend. That’s a steady climb. And it’s not just about quantity. It’s about who benefits:

- Medicare: $137 billion saved in 2023 - that’s $2,672 per beneficiary

- Commercial insurers: $206 billion saved - nearly half of all savings

- Medicaid: The rest - over $100 billion

Therapy areas show where the biggest wins are:

- Heart disease: $118.1 billion saved

- Mental health: $76.4 billion saved

- Cancer: $25.5 billion saved

California alone saved $38 billion in 2023. Alaska saved $354 million. The scale is massive, and it’s not random-it’s tied to population size and drug usage.

Why the Numbers Don’t Always Match

Why does the FDA report $5.2 billion in savings for 2022, but AAM says $408 billion total? Because they’re measuring different things.

The FDA’s number is like counting how many new cars hit the road last year. It’s the immediate impact of new entries. The AAM number is like counting how much gas everyone bought last year. It includes every car on the road, new and old.

Here’s the math behind the FDA’s method: Savings = (Brand price - Generic price) × Generic sales + (Brand price drop) × Brand sales. Simple. Direct. Focused on the moment a new generic enters.

AAM’s method is broader: Total spending on brand drugs minus total spending on generics. That includes every generic approved in the last 10 years still being used today. That’s why it’s so much larger.

Both are right. Both matter. The FDA shows how much innovation drives change. AAM shows how much that change adds up over time.

Who Actually Gets the Savings?

It sounds great: $445 billion saved. But do patients feel it?

Mostly, yes. The average generic copay in 2019 was $6.97. Over 90% of generic prescriptions cost $20 or less. For someone on a chronic medication like high blood pressure or diabetes, switching to a generic can drop a monthly bill from $300 to $15. That’s life-changing.

But here’s the catch: not all savings make it to the patient. Pharmacy benefit managers (PBMs)-the middlemen between insurers, drugmakers, and pharmacies-often keep a big slice of the discount. A 2023 Senate investigation found that only 50-70% of the savings from generics actually reach the consumer. The rest gets absorbed in rebates, fees, and contracts.

State Medicaid programs see it clearly. California’s Medi-Cal saved $23.4 billion in a single year. But patients in that system still face copays. The savings help the state afford more care, but don’t always mean lower out-of-pocket costs for individuals.

The Bigger Picture: Generics Are the Backbone of U.S. Drug Use

Generics make up 90% of all prescriptions filled in the U.S. But they account for only 13.1% of total drug spending. That’s the power of competition. One brand-name drug can cost $500 a month. The generic? $10. That’s why the FDA approved 742 generic applications in 2022 alone.

The pipeline is still full. More than 1,000 drugs are expected to lose patent protection between now and 2030. That includes big names like Humira, Enbrel, and several cancer drugs. Each one will trigger another wave of savings.

And it’s not slowing down. The FDA’s review times have improved dramatically. Thanks to the Generic Drug User Fee Amendments (GDUFA), 95% of applications are reviewed within 10 months. That means generics hit the market faster. More competition. More savings.

What’s Next? Biosimilars and the Future

Generics aren’t the only game in town anymore. Biosimilars-generic versions of complex biologic drugs-are starting to make an impact. As of August 2024, the FDA had approved 59 biosimilars. They’re harder to make, harder to approve, and more expensive. But they’re getting cheaper. And they’re starting to save money.

The AAM projects that by 2028, total savings from generics and biosimilars combined could hit $3.9 trillion since 2014. That’s $450 billion to $500 billion per year. That’s the next frontier.

But challenges remain. Brand companies still use legal tricks-patent thickets, REMS delays, and pay-for-delay deals-to slow down generics. The FDA’s 2023 Drug Competition Action Plan is trying to shut those down. If it works, the savings could climb even higher.

Final Takeaway

The numbers are clear: generic drug approvals are one of the most effective cost-saving tools in American healthcare. 2019 was a record year. 2022 was a comeback. And 2023? The biggest year yet for total savings. It’s not just about the FDA approving pills. It’s about making sure those pills reach the people who need them-and that the savings don’t get lost in the system.

If you’re on a long-term medication, ask your pharmacist: Is there a generic? The answer could save you hundreds-or even thousands-each year. And for the system as a whole? Those billions add up to better access, better care, and real relief.

How does the FDA calculate savings from generic drug approvals?

The FDA measures savings over the first 12 months after a new generic drug is approved. They compare the price of the brand-name drug before and after generic entry, and calculate savings based on two factors: (1) the difference between the brand price and the generic price multiplied by the number of generic prescriptions filled, and (2) the price reduction of the brand drug itself due to competition, multiplied by its remaining sales volume. This method isolates the direct impact of each new generic entry.

Why did generic savings drop in 2020 after being high in 2019?

The 2019 spike was driven by the approval of generics for several high-revenue drugs like Eliquis and Advair. In 2020, fewer blockbuster drugs lost patent protection. The savings from generic approvals are highly concentrated-just a few drugs account for most of the total. So when no major drugs came off patent that year, the savings dropped sharply. It’s not a decline in generic approvals overall, but a gap in high-value approvals.

Do generic drugs save money for patients at the pharmacy counter?

Yes, but not always fully. The average generic copay is around $7, and over 90% of generics cost $20 or less. For chronic conditions, switching from brand to generic can cut monthly costs from hundreds to tens of dollars. However, pharmacy benefit managers (PBMs) often keep part of the discount through rebates and contracts. Studies show only 50-70% of the total savings actually reach the patient.

What’s the difference between FDA savings and AAM savings?

The FDA reports savings from drugs approved in a given year-focusing on the immediate price drop after a new generic enters the market. The Association for Accessible Medicines (AAM) reports total annual savings from all generics in use, regardless of when they were approved. So FDA numbers show the impact of innovation; AAM numbers show the cumulative effect of decades of generic use. That’s why AAM’s total ($445 billion in 2023) is much larger than the FDA’s new-approval number ($5.2 billion in 2022).

Are biosimilars starting to contribute to drug savings?

Yes, but slowly. As of August 2024, the FDA had approved 59 biosimilars-generic versions of complex biologic drugs like Humira and Enbrel. These drugs are harder to replicate, so they’ve entered the market more slowly than traditional generics. Their savings are still modest compared to small-molecule generics, but they’re growing. Experts expect biosimilars to contribute significantly to savings in the coming years, especially as more biologics lose patent protection.

How many generic drugs are approved each year?

The FDA approves hundreds of generic applications annually. In 2022, 742 generic drug applications were fully approved. That includes both first-time generics and additional versions of drugs already available as generics. The number of first generics-the ones that break patent monopolies-fluctuates yearly. In 2022, there were 59 first generics approved. In 2019, there were 47. The total number of approvals depends on patent expirations and regulatory timelines.